Gaming the System: Financial Instrument Valuation, Ethical Issues, and Storytelling Risks

Gaming the System: Financial Instrument Valuation, Ethical Issues, and Storytelling Risks

January 5, 2022A Playtech Financial Analysis, by Dr. Bobby Waldrup

Abstract

This teaching case involves a highly publicized anticipated merger of a publicly traded UK-based gaming corporation, and its subsequent expiry. The case requires students to apply fair value standards relevant to financial instruments and apply reasonableness tests in accordance with International Financial Reporting Standards (IFRS). The case emphasizes the storytelling aspects of financial statement presentation and valuation judgments when corporate management attempts to frame the value of certain assets for constituents. The complex derivatives presented in the case provide a lens through which students explore ethical issues around story-framing to evaluate the concepts of comparability, verifiability, and timeliness on the decision usefulness of asset valuation. This case is appropriate for an intermediate or graduate-level financial accounting or auditing course.

Keywords: financial instruments, fair value, ethics, storytelling

Upon completion of the case, students will be able to:

1. Enhance their understanding and application of IFRS professional accounting guidance, especially concepts around financial instruments fair value estimates.

2. Recognize the inherent risks that accounting estimates and judgement lead to in financial statement presentation of complex financial transactions.

3. Describe ethical issues that may arise in asset fair value estimates that can be resolved using an ethical framework.

4. Create a narrative that coalesces the cumulative ramifications of fair value estimates and judgements across reporting periods.

Case Narrative

Playtech plc is a gambling technology company delivering software, services, content, and platform technology to the industry. Their proprietary technology can be found in online casinos and poker rooms, sports betting venues, and live regulated casinos. The Company provides its technology on a business-to-business basis in partnership with their customers, who in turn provide gambling services directly to consumers. The company was founded in 1999 and is listed and publicly traded on the London Stock Exchange.

According to Fortune Business Insights, the global online gambling software market in which Playtech operates was projected to grow from $66.72 billion in 2020 $158.20 billion in 2028, a CAGR of 11.4%. Cultural and legalization approval, easy access to online gambling, celebrity endorsements, and corporate sponsorships drove market growth in 2022 as did the use of smart phones among online players. The global growth was far exceeded in the US, where according to the American Gaming Association iGaming revenue grew by 139% in 2021 and 35.3 % in 2022 (CAGR of 89%) from $1.55 billion to $5.01 billion.

Playtech provides B2B customers Caliplay, Wplay, OnJoc, and Tenbet Costa Rica technology products and other strategic services in exchange for standard operator revenue and additional B2B services fees. Playtech presents its relationships with these partners on its books as derivative financial assets.

Recently, Playtech’s management entered active merger negotiations with the Las Vegas-based Special Purpose Acquisition Company (SPAC) Tekkorp to form a new corporation including, among other components, Playtech’s 49% ownership call-option in its business partner CaliPlay. As a result of these merger negotiations, Playtech both reclassified and revalued its investment agreement in CaliPlay multiple times across the three reporting years 2020, 2021, and 2022. As of the second half of 2022, this merger did not come to fruition and no longer appears to be the viable opportunity that it appeared in 2021.

Business Relationship Between Playtech and Caliplay

Playtech portrays itself as one of the gambling industry’s leading technology companies delivering business intelligence driven gambling software, services, content and platform technology across the industry’s most popular product verticals, including, casino, live casino, sports betting, virtual sports, bingo and poker.

Tecnologia en Entretenimiento Caliplay, S.A.P.I. de C.V. (“Caliplay”) portrays itself as one of the leaders in the regulated Mexican online casino and sports betting market. Caliente Interactive is the leading online gaming and sports betting operator in Mexico that provides customers with an array of offerings such as real-money online casino wagering and online sports wagering.

During 2014 Playtech entered into an agreement with Turística Akalli, S. A. de C.V, which has since changed its name to Corporacion Caliente SAPI (“Caliente”), the majority owner of Tecnologia en Entretenimiento Caliplay, S. de R.L. de C.V (“Caliplay”) to provide systems and other services in connection with Caliplay’s gambling business.

Playtech made a €16.8 million loan to September Holdings B.V (previously the 49% shareholder of Caliplay), a company which is 100% owned by Caliente, in return for a call option that would grant Playtech the right to acquire 49% of the economic interest of Caliplay for a nominal amount (the “Playtech Call Option”).

During 2021 Caliplay redeemed its share at par from September Holdings, which resulted in Caliente becoming the sole shareholder in Caliplay. Playtech discloses the terms of the existing structured agreement were varied, with the following key changes:

- A new additional option (in addition to the Playtech Call Option) was granted to Playtech which allowed the Group to take up to a 49% equity interest in a new acquisition vehicle should Caliplay be subject to a corporate transaction — this additional option is only exercisable in connection with a corporate transaction and therefore was not exercisable at 31 December 2021 or 31 December 2022 (the “Playtech M&A Call Option”).

- Caliente received a put option which would require Playtech to acquire September Holding Company B.V. for a nominal amount (the “September Put Option”). This option has been exercised and the parties are in the process of transferring legal ownership of September Holding Company B.V. to Playtech.

Playtech has no equity holding in Caliplay or Caliente and is currently providing services to Caliplay including technical and general strategic support services for which it receives income.

If the Playtech Call Option or the Playtech M&A Call Option are exercised, Playtech would no longer be entitled to receive the additional B2B services fee (and will cease to provide the related services) which for the year ended 31 December 2022 was €66.3 million (2021: €49.4 million).

In addition, for 45 days after the finalization of Caliplay’s 2021 accounts, Caliplay also had an option to redeem Playtech’s additional B2B services fee or (if the Playtech Call Option had been exercised at that time) Caliente would have the option to acquire Playtech’s 49% stake in Caliplay (together the “Caliente Call Option”).

As per the public announcement made by Playtech on 6 February 2023, Playtech Plc is seeking a declaration from the English Courts to obtain clarification on a point of disagreement between the parties in relation to the Caliente Call Option. Playtech believes the Caliente Call Option has expired and referred to its expiry having taken place in its interim report for the six-month period ended 30 June 2022, which was published on 22 September 2022. If the Caliente Call Option was declared as being exercisable and was exercised, this would extinguish the Playtech Call Option and the Playtech M&A Call Option.

Financial Statement Reporting by Playtech

The following details Playtech’s financial statement reporting and disclosure of its business relationship with Caliplay and Caliente from its inception in 2014, as reflected in the financial statements as of December 31, 2014 through the financial statements as of December 31, 2022.

1. Playtech’s Audited Financial Statements — December 31, 2014 to December 31, 2018

Playtech first discloses its service agreement with Caliplay in the December 31, 2014 financial statements. It includes a value of the relationship with Caliente / Caliplay as an Investment In Equity Accounted Affiliates — Structured Agreements, but does not disclose the €16.8 million loan or the existence of the Playtech Call Option.

2. Playtech’s Audited Financial Statements — December 31, 2019

Playtech continues to disclose its service agreement with Caliplay. This is the first time Playtech discloses it has a €16.8 million interest in Caliplay as an Investment in Structured Agreements. Playtech does not disclose its €16.8 million interest arose from the €16.8 million loan made in 2014 or the existence of the Playtech Call Option.

3. Playtech’s Audited Financial Statements — December 31, 2020

Playtech continues to disclose its service agreement with Caliplay. It now discloses that Playtech’s €16.8 million basis in Caliplay as an Investment in Structured Agreements was based upon its cumulative payments to Caliplay under the service agreement, but it does not disclose those payments were in the form of a loan. Playtech discloses for the first time the existence of the Playtech Call Option for a 49% interest in Caliplay, which it has assessed as only protective in nature, valued at its €16.8 million cost, and accounted for using the equity method.

4. Playtech’s Unaudited Half-Year Financial Statements — June 30, 2021

Playtech continues to disclose its service agreement with Caliplay. It discloses that during the preceding six months it modified its existing agreement with Caliplay to create a new option, the Playtech M&A Call Option, which was exercisable upon a change in Caliplay’s ownership structure, and gives Playtech a 49% interest in the new structure, which would be applicable to a contemplated SPAC transaction in the second half of 2021, and which would terminate Playtech revenue sharing agreement with Caliplay. The existing Playtech Call Option remained in effect with the new Playtech M&A Call Option.

As part of this modification to the original Playtech Call Option, Playtech issued the Caliente Call Option that gave Caliente the right (for an exercise period of 45 days from Caliplay closing its books) to redeem Playtech’s revenue share related fee or (if the Playtech Call Option had been exercised) buy back the 49% interest from Playtech. The agreement modifications also included the transfer of the €16.8 million loan from the prior Caliente subsidiary, which held the loan, to Caliplay, where it ultimately became the basis for the Playtech M&A Call Option.

Playtech treated the Playtech M&A Call Option as a derivative financial instrument and did not value it using the cost basis. Instead, it valued the derivative Playtech M&A Call Option using a discounted cash flow analysis at €285 million. It should be noted that, at this point in time, the capital markets remained strong for companies comparable to the proposed venture or SPAC due to COVID and the SPAC market was robust.

5. Playtech’s Audited Financial Statements — December 31, 2021

Playtech continues to make similar disclosures regarding the modification of the existing Playtech Call Option, the issuance of a new Playtech M&A Call Option and the issuance of a Caliente Call Option. No material changes were identified to the terms of these three call options from Playtech’s disclosures in the June 30, 2021 unaudited financial statements.

The major change to the three call options was that Playtech no longer used a DCF analysis to value the Playtech M&A Call Option, but based the valuation on the expected terms of a contemplated SPAC transaction, which it deemed to be reasonably certain. That change in valuation methodology increased the Playtech M&A Call Option derivative financial instrument’s valuation from €285.0 million to €506.7 million.

6. Playtech’s Unaudited Half-Year Financial Statements — June 30, 2022

Playtech continues to make similar disclosures regarding the modification of the existing Playtech Call Option, the issuance of a new Playtech M&A Call Option and the issuance of a Caliente Call Option. No material changes were identified to the terms of these three call options from Playtech’s disclosures in the December 31, 2021 audited financial statements.

The major change is that Playtech indicates the SPAC transaction is becoming less certain. Consequently, it no longer uses the expected terms of a contemplated SPAC transaction to determine the valuation of the Playtech M&A Call Option, and readopts the DCF valuation analysis. That change in valuation methodology increased the Playtech M&A Call Option derivative financial instrument’s valuation from €506.7 million to €544.9 million.

7. Playtech’s Unaudited Financial Statements — December 31, 2022

Playtech continues to make similar disclosures regarding the modification of the existing Playtech Call Option, the issuance of a new Playtech M&A Call Option and the issuance of a Caliente Call Option. No material changes were identified to the terms of these three call options from Playtech’s disclosures in the June 30, 2022 unaudited financial statements.

The major change is that Playtech indicates the SPAC transaction will not be moving forward. It continues to use the DCF analysis to determine the value the Playtech M&A Call Option, which changed the derivative financial instrument’s valuation from €544.9 million to €524.0 million.

Case Questions

You have been asked to prepare a business memo in the form of an expert witness report addressing the following questions. Appendix A provides a template of what you should include in this report.

- Review Playtech’s accounting for the call options and compliance with IFRS.

a. Playtech’s Accounting Treatment of the Playtech Call Option.

b. Playtech’s Accounting Treatment of the Playtech M&A Call Option.

i. Should the Playtech M&A Call option be presented under the Equity Method as on a consolidated basis or as a Financial Instrument?

ii. Should the Playtech M&A Call option be presented at Cost or at Fair Value? - Review Playtech’s valuation for the call options and compliance with IFRS.

a. Should the Playtech M&A Call be valued at Fair Value at 12/31/21?

b. Should the Playtech M&A Call be valued at Fair Value at 12/31/22? - Review the reasonableness of Playtech’s valuation for the call options.

a. Should the Playtech M&A Call be valued at €506.7 Million at 12/31/21?

b. Should the Playtech M&A Call be valued at €524.0 million at 12/31/22? - Provide a narrative that explains the cumulative ramifications of fair value estimates and judgements across reporting periods. How is management framing the story of these assets, and is this frame in accordance with the expectation of Fair and Accurate financial statement representations?

Implementation Guidelines

The case is being classroom tested in three classes at two private universities. The first is an MBA course on decision-making in accounting which focuses on understanding the story management portrays by financial statement assertions. The second class is a Master of Accounting (MAcc) course in audit analytics which focuses upon compliance with IFRS guidance on asset recognition and valuation. Finally, the third course is a capstone MAcc course which integrates accounting regulatory guidance, management decision making, and ethics.

Evidence of Learning Efficacy

Efficacy is being developed through survey results in each of the classes. The feedback questions focus on two aspects of the assignment: questions relating to students’ understanding of the business practices being reflected, and questions relating to students’ understanding of and ability to apply the relevant IFRS standards.

Case Solution

The case solution can be found in a supplemental file and is posted in the teaching notes. The case solution is framed as the case author presenting an expert witness report in the first person to demonstrate proper formatting, content, and evaluation methods.

References

- International Accounting Standards 8, Accounting Policies, Changes in Accounting Estimates and Errors.

- International Accounting Standards 28, Investments in Associates and Joint Ventures.

- International Accounting Standards 39, Financial Instruments: Recognition and Measurement.

- International Financial Reporting Standards, Conceptual Framework for Financial Reporting.

- International Financial Reporting Standards 7, Financial Instruments: Disclosures.

- International Financial Reporting Standards 9, Financial Instruments.

- International Financial Reporting Standards 10, Consolidated Financial Statements.

Appendix A

Accounting Expert Report Template

I. Executive Summary

A. Scope of the Investigation

Need to establish what you are investigating — what specific accounting issue or transaction(s) will you be addressing?

B. Qualifications

Need to establish you are qualified as an expert to offer an opinion on a technical matter involving accounting.

If the possibility exists that expert reports could be used in litigation, experts and their reports must pass the Daubert standard in court, which involves proving that they are qualified to be an expert on the topic of the report.

C. Documentation Reviewed and Analyses

Need to identify the documents reviewed and the analysis performed. This informs the reader what information you used in developing your findings and conclusions and what analyses you performed using this information.

The executive summary section can refer to the documentation at a summarized level and the detailed document listing, which should be comprehensive, can be included as an appendix.

If possible, the analytical procedures can also be presented in a summarized format in the section of the report, but consideration should be given to how they are organized. Often, if the report is addressing key questions or issues, it is helpful to organize the analytic procedures to parallel those elements. In other words, this section of the report’s organization should follow the presentation of the following section’s findings and conclusions.

D. Findings & Conclusions

This section of the report is critically important and requires a great deal of consideration. Again, it should be organized in a manner that logically groups the findings and conclusions by topical area, by technical accounting issue, or by the chronological order of the events.

The findings and conclusions must be summarized for the executive summary presentation; however, they must include sufficient relevant facts such that the reader can understand the basis of your findings and conclusions. In making this determination, you should consider that your detailed findings and conclusions will appear in a separate section of this report.

It can be helpful to format this part of the report into subsections that address each key conclusion. For example:

- Accounting Treatment of ABC

- Accounting Treatment of DEF

- Accounting Treatment of XYZ

In some instances, there may be an issue with respect to the accounting treatment, for example the fair value of a reported asset, and then an issue with respect to the amount of the reserve that was established. In those types of cases, you should give consideration to using two subsections, one for the propriety of the accounting treatment and the other for the propriety of the amount.

II. Background

12

conclusions. In making this determination, you should consider that your detailed findings and conclusions will appear in a separate section of this report.

It can be helpful to format this part of the report into subsections that address each key conclusion. For example:

1. Accounting Treatment of ABC

2. Accounting Treatment of DEF

3. Accounting Treatment of XYZ

In some instances, there may be an issue with respect to the accounting treatment, for example the fair value of a reported asset, and then an issue with respect to the amount of the reserve that was established. In those types of cases, you should give consideration to using two subsections, one for the propriety of the accounting treatment and the other for the propriety of the amount.

II. Background

A. General Background

This part of the report should be used to give detailed background on the company or companies that are included in the analysis, any transactions that are in question, and any other background information that would be helpful to understanding the report.

B. Financial Reporting

This part of the report should provide detailed information on how the company accounted for the subject matter of the analysis, findings and conclusions. This section should be written in such a manner that the reader does not have to be an accountant or well versed in accounting to understand. The more detailed and accounting-oriented material should be included in the Findings and Conclusions section (section IV. below) of the report. This information should set the stage for the more complex issues.

III. Methodology

This section should set forth the methodology that was used for each specific area of the findings and conclusions. As such, it should be consistent with the organization of the prior sections of the report (i.e., by topical area, issue or chronology).

Typically, this section of the report states what information was used in the analysis and how that information was analyzed. For example, the information may include financial statements, trial balances, general ledgers, industry studies, articles, industry practices, comparable companies, and comparable transactions.

The description of the analysis of this information usually involves applying relevant accounting rules to a particular situation. The description of the procedures should be general in nature and leave the reader with an understanding of the objective of the analysis, but not the specific detailed procedures of the analysis, which are included in the findings and conclusions section.

IV. Findings and Conclusions

This section of the report should set forth the specific analytical procedures performed, which should identify the specific relevant accounting rules, and why the application of the specific accounting rules lead to the resulting conclusion. In this section of the report, while efforts should be made to make the material understandable to non-accountants, in most cases, that is not possible. This is the section of the report that can be highly technical and highly detailed. In developing this section, it is important to include sufficient information that can withstand the review and criticism of other parties who are also accounting experts.

It is important to have clear conclusions that are identified as conclusions. The conclusion should be as specific as possible. Where possible, it should also address any potential contrary opinion.

It may be advisable, in some circumstances, to have a conclusion, but recognize that often expert reports are used to reach agreements, where secondary or tertiary conclusions could be possible. For example, if the finding is that the fair value is X based upon the following reasons, it may be useful to also note that if additional information becomes available, then the fair value could be Y or even Z. However, it must be made clear that fair value X is the conclusion to avoid diluting or raising doubt about the conclusion.

Sample Report

Gaming the System: Financial Instrument Valuation, Ethical Issues and Storytelling Risks

Bobby E. Waldrup

Loyola Universuity Maryland

Case Solution

I. Executive Summary

A. Scope of the Investigation

I, [Bobby Waldrup], have performed an analysis of Playtech plc (“Playtech” or “the Company”) to determine the Company’s compliance with International Financial Reporting Standards (“IFRS”) for reporting its business relationship with Caliplay, which centers around a long-term service agreement between the two companies. Specifically, my analysis was focused on Playtech’s accounting treatment and valuation of the options that arose from that service agreement. This report documents my findings regarding this matter as of [May 2, 2023].

B. Qualifications

I am currently a Professor of Accounting at Loyola University in Baltimore, Maryland. Prior to this appointment I served as the Interim Dean of the Sellinger School of Business. I am a Ph.D. in Accounting with over 23 years of professional experience. I am recognized as a specialist in the field of forensic and fraud accounting. I am named by Forensic Colleges of America as a Top 15 Forensic Professor, and I have written 15 peer reviewed publications and given over 13 professional talks on the subject. I hold certifications of educational memberships as a CPA (inactive), the American Accounting Association, and the Association of Certified Fraud Examiners. I have previously worked on forensic technical analysis for Fortune 500 companies, the US Paper Trade Association, and am currently an expert witness in the federal court system.

(see Appendix A for complete Curriculum Vitae)

C. Documentation Reviewed and Analyses

My review and analysis was limited to publicly available information, principally Playtech’s audited and unaudited half-year and annual financial statements from December 31, 2014 to December 31, 2022. In addition, I reviewed other publicly available information, primarily media reports of the contemplated transaction with a Special Purpose Acquisition Vehicle (“SPAC”) during 2021 and 2022 involving Playtech and Caliplay. Finally, I reviewed publicly available financial statements and information on comparable companies in the online gaming, hospitality and entertainment industries. (see Appendix B for listing of documentation) My analysis encompassed Playtech’s compliance with IFRS accounting standards and its valuation of the two options to acquire 49% of Caliplay. The first option (the “Playtech Call Option”) was issued to Playtech in 2014 as consideration for Playtech’s €16.8 million loan to Caliplay. The loan was first disclosed in the June 30, 2021 half-year financial statements. The second option (the “Playtech M&A Call Option”) was issued to Playtech in 2021, in advance of a contemplated SPAC transaction. Concurrent with the Playtech M&A Call Option, Playtech issued to Caliplay’s parent, Caliente, a call option (the “Caliente Call Option”) that gave Caliente the right, for a limited period of time, to redeem Playtech’s additional B2B service fee or (if the Playtech Call Option had been exercised at that time) acquire Playtech’s 49% stake in Caliplay. Playtech accounted for its original Playtech Call Option under the equity accounting method and valued its Investment in Associates (Caliplay) based upon the original €16.8 million loan, which later became part of the Playtech M&A Call Option transaction. Playtech determined the equity accounting method to be appropriate because Playtech did not control Caliplay and the Playtech Call Option remained exercisable as of December 31, 2021 and December 31, 2022. Under the equity accounting method, Playtech chose not to account for its share of the profits in Caliplay because the current 100% shareholder, Caliente, was entitled to any undistributed profits. Playtech accounted for the new Playtech M&A Call Option as a derivative financial instrument and valued the derivative at €285.0 million as of June 30, 2021. That valuation was based upon a discounted cash flow (“DCF”) analysis of Caliplay’s future operations. Playtech continued to account for the Playtech M&A Call Option as a derivative financial instrument and valued the derivative at €506.7 million as of December 31, 2021. That valuation no longer used a DCF analysis but was based upon the anticipated enterprise value of Caliplay predicated upon the expected acquisition of Caliplay by a US listed special purpose acquisition company (SPAC). During 2022, the industry-related capital markets deteriorated, and the proposed SPAC transaction was unsuccessful. Playtech continued to treat the Playtech M&A Call Option as a derivative financial instrument and valued the derivative, again using the discounted cash flow (DCF) analysis, at €544.9 million as of June 30, 2022 and €524.0 million as of December 31, 2022. Playtech determined that it was appropriate to account for the Playtech M&A Call Option as a derivative financial instrument because Playtech could not exercise the Playtech M&A Call Option as of June 30, 2021, December 31, 2021, June 30, 2022 and December 31, 2022. My analysis focused on Playtech’s accounting treatment of the Playtech Call Option and Playtech M&A Call Option and its valuation of the derivative as presented in the full year financial statements as of December 31, 2021 and December 31, 2022.

D. Findings & Conclusions

- Playtech’s Accounting Treatment of the Playtech Call Option

Based upon my review and analysis of publicly available documentation, I determined that Playtech’s accounting for the Playtech Call Option under the equity method was appropriate and consistent with the IFRS accounting rules. During 2021 and 2022, Playtech had the right to exercise the Playtech Call Option at its sole discretion, which is a prerequisite for the equity accounting method; the Playtech Call Option is for a 49% ownership interest, which falls between the 20% to 49% range proscribed for equity method accounting; Playtech’s lack of control over Caliplay is similarly prerequisite for equity method accounting; Playtech’s decision to value the investment based upon the €16.8 million loan that gave rise to the option was appropriate; and Playtech’s decision not to increase its investment for its share of Caliplay’s profits that could only be distributed by Caliente was also appropriate - Playtech’s Accounting Treatment of the Playtech M&A Call Option

Based upon my review and analysis of publicly available documentation, I determined that Playtech’s accounting for the Playtech M&A Call Option as a derivative financial instrument was appropriate and consistent with the IFRS accounting rules. During 2021 and 2022, Playtech did not control Caliplay, which would have required it to be consolidated into Playtech’s financial statements; the Playtech M&A Call Option was not exercisable, which would have required it to be accounted under the equity method as an investment in associate; and the structure of the Playtech M&A call option otherwise met the requirements of a derivative financial instrument. - Playtech’s Valuation of the Playtech M&A Call Option — December 31, 2021

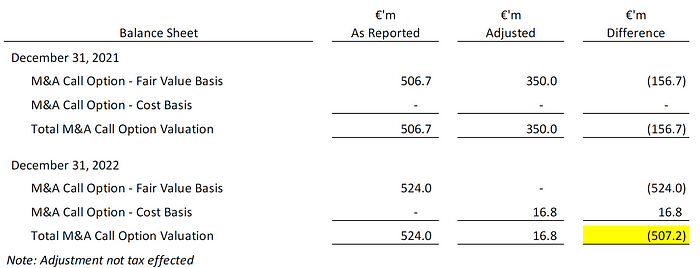

Based upon my review and analysis of publicly available documentation, I determined that Playtech’s €506.7 million valuation of the Playtech M&A Call Option, while based upon the terms of a contemplated SPAC transaction, is not accurate because it does not reflect the fact that it would be in Caliente’s best interest to concurrently exercise its own Call Option, which would reduce the valuation of Playtech’s M&A Call Option.

Since Playtech had not exercised its Playtech Call Option, which was a prerequisite for Caliente to repurchase Playtech’s 49% interest in Caliplay, Caliente’s only course of action under its option would be to redeem its interest in Playtech’s profit share related fee, which would supersede the Playtech M&A Call Option. As such, the profit share redemption represents the maximum Playtech could expect to receive during the period that the Caliente Call Option was exercisable, which existed as of December 31, 2021.

My estimate of the value of the profit share redemption is based upon information provided in the 2021 financial statements. Therefore, I believe the derivative financial instrument’s valuation should be €350.0 million. Thus, Playtech overstated its reported Derivative Financial Assets by €156.7 million (€506.7 million — €350.0 million = €156.7 million). See Section 5 below for overall impact on Playtech’s financial statements. - Playtech’s Valuation of the Playtech M&A Call Option — December 31, 2022

Based upon my review and analysis of publicly available documentation, I determined that Playtech’s €524.0 million valuation of the Playtech M&A Call Option does not meet the IFRS requirements to value this derivative financial instrument at fair value, consequently, it should be valued using its €16.8 million cost.

IFRS requires derivative financial instruments to be valued using fair value, except in cases where the variability in the range of reasonable fair value estimates is significant for that instrument and the probabilities of the various estimates within those ranges cannot be reasonably assessed. For those situations, IFRS requires the derivative financial instrument to be valued at cost. I believe the level of uncertainty surrounding the valuation of the Playtech M&A Option is sufficient to require the Company to use the cost basis.

In this case, those uncertainties include the failure of the contemplated Caliplay SPAC transaction; the deterioration in the industry-related capital markets that reduced comparable company valuations by over 40% in 2022; the failure of other contemplated SPAC transactions to close; the growing losses at comparable companies due to rapidly increasing customer acquisition costs and limited brand loyalty; and the fact the industry has a large number of companies pursuing similar business models.

I believe among the greatest uncertainties that preclude the valuation of the derivative financial instrument is the timing of when Caliente will enter into a transaction that would trigger the Playtech M&A Option. The failure of the contemplated SPAC and comparable company valuation declines exceeding 40% has markedly changed the probability of any corporate transaction closing with the same economics. Further, it remains highly uncertain when, or even if, the economics for any M&A type transactions will approach the levels that existed in 2021, particularly as the market returns to a more normal and established state.

The question is not whether the Playtech M&A Call Option has any value; it does. In this case, the question is whether corresponding Caliplay valuation is sufficient to motivate Caliente to pursue a transaction that would trigger the exercise of the Playtech M&A Option. Playtech skirts raising this issue within its valuation analysis by, inexplicably in light of all these factors, raising its valuation of this financial derivative from €506.7 million in 2021 to €524.0 million in 2022. How is it possible that Caliplay is worth more in the current market than it was slightly over a year ago when a SPAC transaction was in play involving a major media company that would expand its operations into the United States? Based upon current market conditions, it could be years before Caliente pursues a transaction that provides the same economics as the contemplated SPAC in 2021. How is it possible Playtech assumes a comparable transaction will occur within the next four years as one of the key assumptions in its DCF valuation analysis?

In conclusion, I believe the level of certainty that existed in during 2021 that permitted Playtech to value the derivative financial instrument for the Playtech M&A Call Option using the terms of the contemplated SPAC transaction no longer exists as of December 31, 2022. As such, IFRS requires Playtech to base its valuation solely upon the cost of the financial instrument, which in this case is €16.8 million.

Thus, Playtech overstated its reported Derivative Financial Assets by €507.2 million (€524.0 million — €16.8 million = €507.2 million). See Section 5 below for overall impact on Playtech’s financial statements.

However, in the unlikely event that it is determined, from information Playtech failed to publicly disclose, that sufficient certainty exists with respect to the valuation assumptions, I believe Playtech’s €524 million valuation substantially overstates the value of the Playtech M&A Call Option derivative financial instrument. An analysis of publicly traded companies within Caliplay’s and the contemplated SPAC’s industries revealed that market values have declined by 42% from December 31, 2021 to December 31, 2022. Further, smaller companies that are comparable to the to the proposed venture or SPAC have experienced market values declined of 54% over this same period. Applying these percentage declines during 2022 to Playtech’s €524.0 million valuation as of December 31, 2021 yields a range of values for this derivative from €302.9 million to €241.0 million.

As a point of reference, I estimate the cost to Caliente to exercise the Playtech Call Option and the Caliente Call Option is €350 million, which indicates that maintaining the current service agreement between Caliplay and Playtech is more economically attractive to both parties than either party exercising the options. That would appear to indicate that while the Playtech M&A Call Option has some value, it is currently out of the money by at least €50 million to €100 million, and unless market conditions markedly improve to 2022 levels, will remain so for the foreseeable future. - Improper Accounting Materially Overstated Playtech’s Assets and Income

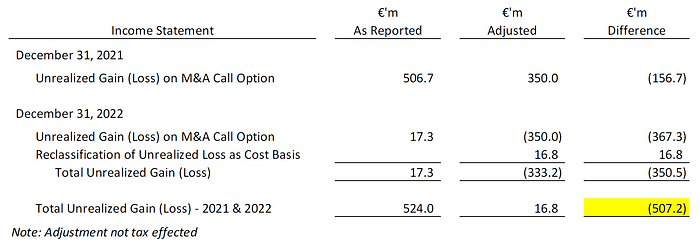

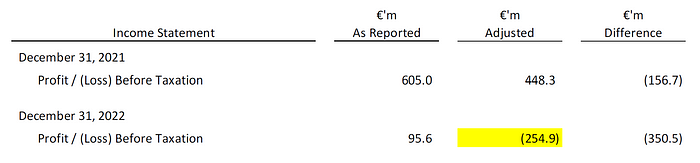

I found that Playtech’s improper accounting for the Playtech M&A Call Option materially overstated the Company’s income and assets in the December 31, 2021 and December 31, 2022 financial statements.

As previously noted, I found that the combination of Playtech’s improper accounting and valuations overstated Playtech’s assets by €156.7 million as of December 31, 2021 and by €507.2 million as of December 31, 2022. The €507.2 million overstatement represented 14.5% of Playtech’s reported total assets of €3,495.6 million and 42.4% (not tax effected) of its reported total equity of €1,193.8 million as of December 31, 2022.

The improper accounting and valuations that overstated Playtech’s assets also overstated its Unrealized Gain (Loss) on the M&A Call Option.

The overstated Unrealized Gain on the M&A Call Option also materially overstated Playtech’s reported Profit Before Taxation (comparable to Net Income Before Taxes) for each of the two year’s ended December 31, 2021 and December 31, 2022.

The improper accounting and valuation of the M&A Call Option overstated Playtech’s reported Profit Before Taxation by €156.7 million in 2021, and allowed it to report near break-even results for 2022 (Profit Before Taxation of €95.6 million) when it should have reported a substantial Loss Before Taxation of (€254.9 million) in 2022.

II. Background

A. Business Relationship Between Playtech and Caliplay

Playtech portrays itself as one of the gambling industry’s leading technology companies delivering business intelligence driven gambling software, services, content and platform technology across the industry’s most popular product verticals, including, casino, live casino, sports betting, virtual sports, bingo and poker.

Tecnologia en Entretenimiento Caliplay, S.A.P.I. de C.V. (“Caliplay”) portrays itself as one of the leaders in the regulated Mexican online casino and sports betting market. Caliente Interactive is the leading online gaming and sports betting operator in Mexico that provides customers with an array of offerings such as real-money online casino wagering and online sports wagering.

During 2014 Playtech entered into an agreement with Turística Akalli, S. A. de C.V, which has since changed its name to Corporacion Caliente SAPI (“Caliente”), the majority owner of Tecnologia en Entretenimiento Caliplay, S. de R.L. de C.V (“Caliplay”) to provide systems and other services in connection with Caliplay’s gambling business.

Playtech made a €16.8 million loan to September Holdings B.V (previously the 49% shareholder of Caliplay), a company which is 100% owned by Caliente, in return for a call option that would grant Playtech the right to acquire 49% of the economic interest of Caliplay for a nominal amount (the “Playtech Call Option”).

During 2021 Caliplay redeemed its share at par from September Holdings, which resulted in Caliente becoming the sole shareholder in Caliplay. Playtech discloses the terms of the existing structured agreement were varied, with the following key changes:

- A new additional option (in addition to the Playtech Call Option) was granted to Playtech which allowed the Group to take up to a 49% equity interest in a new acquisition vehicle should Caliplay be subject to a corporate transaction — this additional option is only exercisable in connection with a corporate transaction and therefore was not exercisable at 31 December 2021 or 31 December 2022 (the “Playtech M&A Call Option”).

- Caliente received a put option which would require Playtech to acquire September Holding Company B.V. for a nominal amount (the “September Put Option”). This option has been exercised and the parties are in the process of transferring legal ownership of September Holding Company B.V. to Playtech.

Playtech has no equity holding in Caliplay or Caliente and is currently providing services to Caliplay including technical and general strategic support services for which it receives income.

If the Playtech Call Option or the Playtech M&A Call Option are exercised, Playtech would no longer be entitled to receive the additional B2B services fee (and will cease to provide the related services) which for the year ended 31 December 2022 was €66.3 million (2021: €49.4 million).

In addition, for 45 days after the finalization of Caliplay’s 2021 accounts, Caliplay also had an option to redeem Playtech’s additional B2B services fee or (if the Playtech Call Option had been exercised at that time) Caliente would have the option to acquire Playtech’s 49% stake in Caliplay (together the “Caliente Call Option”).

As per the public announcement made by Playtech on 6 February 2023, Playtech Plc is seeking a declaration from the English Courts to obtain clarification on a point of disagreement between the parties in relation to the Caliente Call Option. Playtech believes the Caliente Call Option has expired and referred to its expiry having taken place in its interim report for the six-month period ended 30 June 2022, which was published on 22 September 2022. If the Caliente Call Option was declared as being exercisable and was exercised, this would extinguish the Playtech Call Option and the Playtech M&A Call Option.

B. Financial Statement Reporting

The following details Playtech’s financial statement reporting and disclosure of its business relationship with Caliplay and Caliente from its inception in 2014, as reflected in the financial statements as of December 31, 2014 through the financial statements as of December 31, 2022.

- Playtech’s Audited Financial Statements — December 31, 2014 to December 31, 2018

Playtech first discloses its service agreement with Caliplay in the December 31, 2014 financial statements. It includes a value of the relationship with Caliente / Caliplay as an Investment In Equity Accounted Affiliates — Structured Agreements, but does not disclose the €16.8 million loan or the existence of the Playtech Call Option. - Playtech’s Audited Financial Statements — December 31, 2019

Playtech continues to disclose its service agreement with Caliplay. This is the first time Playtech discloses it has a €16.8 million interest in Caliplay as an Investment in Structured Agreements. Playtech does not disclose its €16.8 million interest arose from the €16.8 million loan made in 2014 or the existence of the Playtech Call Option. - Playtech’s Audited Financial Statements — December 31, 2020

Playtech continues to disclose its service agreement with Caliplay. It now discloses that Playtech’s €16.8 million basis in Caliplay as an Investment in Structured Agreements was based upon its cumulative payments to Caliplay under the service agreement, but it does not disclose those payments were in the form of a loan. Playtech discloses for the first time the existence of the Playtech Call Option for a 49% interest in Caliplay, which it has assessed as only protective in nature, valued at its €16.8 million cost, and accounted for using the equity method. - Playtech’s Unaudited Half-Year Financial Statements — June 30, 2021

Playtech continues to disclose its service agreement with Caliplay. It discloses that during the preceding six months it modified its existing agreement with Caliplay to create a new option, the Playtech M&A Call Option, which was exercisable upon a change in Caliplay’s ownership structure, and gives Playtech a 49% interest in the new structure, which would be applicable to a contemplated SPAC transaction in the second half of 2021, and which would terminate Playtech revenue sharing agreement with Caliplay. The existing Playtech Call Option remained in effect with the new Playtech M&A Call Option.

As part of this modification to the original Playtech Call Option, Playtech issued the Caliente Call Option that gave Caliente the right (for an exercise period of 45 days from Caliplay closing its books) to redeem Playtech’s revenue share related fee or (if the Playtech Call Option had been exercised) buy back the 49% interest from Playtech. The agreement modifications also included the transfer of the €16.8 million loan from the prior Caliente subsidiary, which held the loan, to Caliplay, where it ultimately became the basis for the Playtech M&A Call Option.

Playtech treated the Playtech M&A Call Option as a derivative financial instrument and did not value it using the cost basis. Instead, it valued the derivative Playtech M&A Call Option using a discounted cash flow analysis at €285 million. It should be noted that, at this point in time, the capital markets remained strong for companies comparable to the proposed venture or SPAC due to COVID and the SPAC market was robust. - Playtech’s Audited Financial Statements — December 31, 2021

Playtech continues to make similar disclosures regarding the modification of the existing Playtech Call Option, the issuance of a new Playtech M&A Call Option and the issuance of a Caliente Call Option. No material changes were identified to the terms of these three call options from Playtech’s disclosures in the June 30, 2021 unaudited financial statements.

The major change to the three call options was that Playtech no longer used a DCF analysis to value the Playtech M&A Call Option, but based the valuation on the expected terms of a contemplated SPAC transaction, which it deemed to be reasonably certain. That change in valuation methodology increased the Playtech M&A Call Option derivative financial instrument’s valuation from €285.0 million to €506.7 million. - Playtech’s Unaudited Half-Year Financial Statements — June 30, 2022

Playtech continues to make similar disclosures regarding the modification of the existing Playtech Call Option, the issuance of a new Playtech M&A Call Option and the issuance of a Caliente Call Option. No material changes were identified to the terms of these three call options from Playtech’s disclosures in the December 31, 2021 audited financial statements.

The major change is that Playtech indicates the SPAC transaction is becoming less certain. Consequently, it no longer uses the expected terms of a contemplated SPAC transaction to determine the valuation of the Playtech M&A Call Option, and readopts the DCF valuation analysis. That change in valuation methodology increased the Playtech M&A Call Option derivative financial instrument’s valuation from €506.7 million to €544.9 million. - Playtech’s Unaudited Financial Statements — December 31, 2022

Playtech continues to make similar disclosures regarding the modification of the existing Playtech Call Option, the issuance of a new Playtech M&A Call Option and the issuance of a Caliente Call Option. No material changes were identified to the terms of these three call options from Playtech’s disclosures in the June 30, 2022 unaudited financial statements.

The major change is that Playtech indicates the SPAC transaction will not be moving forward. It continues to use the DCF analysis to determine the value the Playtech M&A Call Option, which changed the derivative financial instrument’s valuation from €544.9 million to €524.0 million.

III. Methodology

I performed the following procedures to determine: 1.) whether Playtech’s accounting treatment of the Playtech Call Option and Playtech M&A Call Option were in compliance with the applicable IFRS rules, 2.) whether the valuations of the two call options were in compliance with the applicable IFRS rules, and, 3.) whether the valuations of the two call options were reasonable.

A. Review of Playtech’s Accounting for Call Options and Compliance with IFRS

I reviewed the Playtech financial statements, specifically the disclosures pertaining to its significant accounting policies, to determine what IFRS rules were being applied to the accounting for call options. I cross referenced Playtech’s IFRS references against the relevant IFRS rules to ascertain that the proper rules were being applied to account for the two call options. I reviewed other accounting literature to verify that Playtech was implementing the applicable IFRS rules properly.

B. Review of Playtech’s Valuation of Call Options and Compliance with IFRS

I reviewed the Playtech financial statements, specifically the disclosures pertaining to its significant accounting policies, to determine what IFRS rules were being applied to the valuation of call options. I cross referenced Playtech’s IFRS references against the relevant IFRS rules to ascertain that the proper rules were being applied to value the two call options. I reviewed other accounting literature to verify that Playtech was implementing the applicable IFRS rules properly.

C. Review of Reasonableness of Playtech’s Valuation of Call Options

I reviewed and analyzed the financial statements of other companies in Caliplay and the contemplated SPAC’s industries to develop a dataset of comparable companies. I analyzed the market value of comparable companies to assess any changes or trends in the valuations from 2021 to 2022. I reviewed and analyzed the financial statements of SPAC’s to develop a dataset of companies comparable to the proposed venture or SPAC to assess any changes or trends in the valuations from 2021 to 2022. I conducted extensive research of publicly available information on Caliplay and the contemplated SPAC’s industries’ trends and developments that would impact the future valuation of comparable companies. I compared the results of this research with Playtech’s valuation of its call options.

IV. Findings and Conclusions

A. Playtech’s Accounting Treatment of the Playtech Call Option

Prior to 2021, Playtech accounted for the Playtech Call Option as an Investment in Structured Agreement under the Equity Method in accordance with SFAS 9, para 4.1.2 under the following guidelines: A financial asset shall be measured at amortized cost when (1) the financial asset is held within a business model whose objective is to hold financial assets in order to collect contractual cash flows, and (2) the contractual terms of the financial asset give rise on specified dates to cash flows. I determined that this is appropriate.

In 2021 (and 2022), Playtech reclassified the Playtech Call Option from an Investment in Structured Agreement to a Derivative Financial Asset under the Fair Value Method at a carrying value of the purchase price (€16.8 million) with the introduction of the Playtech M&A Call Option. The carrying value of this Playtech Call Option was then subsumed into the larger valuation treatment of the new Playtech M&A Call Option. This was conducted under IFRS 9, chapter 5.6. Reclassification of Financial Assets and followed as per IFRS 9, chapter 5.6, para 1–7. I determined that this is appropriate.

B. Playtech’s Accounting Treatment of the Playtech M&A Call Option

At June 30, 2021, Playtech presented a new option (Playtech M&A Call Option) as a Financial Instrument at a carrying value under the Fair Value Method based upon a discounted cash flows methodology. There are two overarching questions in determining this presentation.

- Should the Playtech M&A Call option be presented under the Equity Method as on a consolidated basis or as a Financial Instrument?

The key criteria to determine the correct presentation are that classification under the consolidated method as (1) the Equity Method requires control to be demonstrated, or (2) Financial Instrument requires significant influence to be demonstrated (IFRS 10, para 7).

With respect to control, Playtech acknowledged that it does not have control over CaliPlay, in the following ways: (1) the Call option was not currently exercisable, (2) Playtech did not have access to the current undistributed profits of CaliPlay, and (3) Playtech did not have the power to direct relevant activities in order to change #’s 1 and 2 above. (IAS 28, para 6)

With respect to significant influence, Playtech asserts influence through the following indicators: (1) Playtech has the ability to appoint a Board Director and influence the appointments of Caliente’s COO and CMO. (2) Playtech’s standard operator revenues combined with Caliente’s additional B2B service fee indicates significant influence, and (3) the material level of the historical loan funding between Playtech and Caliente indicates additional significance influence.

With the combination of these key criteria, Playtech asserts that the Playtech M&A Call option is treated as a Financial Instrument (IAS 28, para 14; IFRS 9). I determined that this is appropriate. - Should the Playtech M&A Call option be presented at Cost or at Fair Value?

The key criteria to determine the correct presentation of valuation methodology is that financial instruments should be presented at Cost or Fair Value (through comprehensive income or profit and loss) on the basis of (1) the entity’s business model for managing financial assets, and (2) the contractual cash flow characteristics of the financial asset.

There is a general presumption in the statutes that fair value can be measured for an asset purchased from an outside party. The main exception to this is for unquoted equity instruments and derivatives that are linked to and must be settled by delivery of such unquoted equity instrument where (1) the variability in the range of reasonable fair value estimates is significant for that instrument; and (2) the probabilities of the various estimates within the range cannot be reasonably assessed. For such situations, the financial instruments are required to be measured at cost. (IFRS 9, para 4; IAS 39, para 46(c)).

Playtech takes the position under IFRS 9 that the Playtech M&A Call option is a derivative financial asset and presents it at Fair Value. In meeting the two basis’s for fair value presentation, the Group demonstrates the following characteristics: (1) Playtech’s treatment of the Call option does appear to match their general business model. In 2021 and 2022, the Playtech Group presents five derivative financial assets related to their similar relationships with CaliPlay, Wplay, Tenbet, and Onjoc. Each of these are presented at fair value, however only the CaliPlay-related Call option (Playtech M&A option) rises to such a level of financial materiality for Playtech. (2) In 2022, the Fair Value valuation methodology includes a discounted cash flow approach with a market exit multiple assumption. This replaced an evaluation methodology in 2021 whereas the company based the Call option value on an expected merger with a SPAC including the transaction value at time (the transaction never materialized).

At FYE 2021, Playtech valued the Playtech M&A Call Option at Fair Value, specifically at a value commensurate with an identified, measurable, and anticipated merger agreement with a U.S. Based SPAC. The valuation methodology employed moved from Cost to the Fair Value. I determined that this is appropriate. (See D1 below for more discussion).

The valuation metrics utilized did not appear to include the valuation capping effect of the offsetting Caliente Call Option. I determined that this is NOT appropriate. (See D2 below for more discussion).

At FYE 2022, Playtech valued the Playtech M&A Call Option at Fair Value. After the 2021 SPAC merger failed to materialize, Playtech revalued the Playtech M&A Call Option at a discounted cash flow net present value with an anticipated market multiplier at a level commensurate with the terms of the previous SPAC merger agreement. I determined that this is NOT appropriate. (See E below for more discussion).

D. Playtech’s Valuation of the Playtech M&A Call Option — December 31, 2021

At December 31, 2021, Playtech valued the new option (Playtech M&A Call Option) as a Financial Instrument at €506 million . There are two overarching questions in determining this presentation.

- Should the Playtech M&A Call be valued at Fair Value at 12/31/21?

At FYE 2021, Playtech valued the Playtech M&A Call Option at Fair Value, reclassifying the financial instrument from the Cost method to the Fair Value method. At that time Playtech asserted the existence of negotiations with a U.S. based SPAC to exercise the Playtech M&A Call Option to exchange Playtech’s right to 49% of CaliPlay for a significant minority interest in a new (unnamed) entity involving Tekkorp. These assertions are verified by outside news reports detailing these negotiations. (IFRS 9, 4.1.1–4.1.5 Classification of Financial Assets) I determined that this is appropriate. - Should the Playtech M&A Call be valued at €506.7 Million at 12/31/21?

In the FYE 2021 Annual Report, Playtech valued the Playtech M&A Call Option at €506.7 million. The terms of the SPAC transaction were known at that time by all parties, and the valuation was attached to an identified, measurable, and anticipated merger agreement. However, the valuation metrics utilized did not appear to include the valuation capping effect of the offsetting Caliente Call Option. This open-ended option would have served to limit the cash flows Playtech would have enjoyed from the proposed merger. (IFRS 7; IAS 8 para 34–40). I determined that this is NOT appropriate.

I estimated that the value of the Caliente Call Option derivative financial instrument would be €350 million based upon the net present value of the expected services fees discounted at 20% required rate of return. I assumed a 6.1% CAGR of the €66.3 million 2022 B2B services fees through 2034 [Playtech’s FY 2022 Results page 63].

Therefore, the valuation analysis should not only reflect the value derived from the terms of the expected SPAC, which Playtech valued at €506.7 million, but must also consider the Caliente Call Option, which, if exercised, would allow Caliente to effectively “buyout” Playtech’s M&A Call Option for €350 million (the estimated value for Caliente to redeem the Playtech profit share related fee).

Clearly, it is in Caliente’s best financial interest to exercise its call option, which I estimate would pay Playtech €350 million. As such, it is the Caliente Call Option, and not the Playtech M&A Call Option, that would determine the consideration Playtech would receive from a transaction that would trigger the Playtech M&A Call Option. As of December 31, 2021, this derivative financial instrument’s valuation should be €350 million and not €506.7 million.

E. Playtech’s Valuation of the Playtech M&A Call Option — December 31, 2022

In the FYE 2022 Annual Report, Playtech valued the Playtech M&A Call Option under the Fair Value method at €524 million. At that time the proposed SPAC merger was determined to be no longer viable and there was no asserted merger activity with any identified partners.

- Should the Playtech M&A Call be valued at Fair Value at 12/31/22?

At FYE 2022 Playtech’s M&A Call Option could no longer be valued based upon the anticipated closing of the SPAC transaction. Playtech continued to present the Playtech M&A Call Option under Fair Value with a revised methodology of discounted cash flow net present value with an anticipated market multiplier at a level commensurate with the terms of the previous SPAC merger agreement. Playtech notes that this valuation is drawn on the basis of estimated discount rates, industry growth rates, assumed market multipliers, and other “unobservable inputs”. (Playtech Full Year Results Report, Note 6, 2022)

A financial instrument must be valued on the basis of variables that allow for Comparability, Verifiability, and Timeliness (IFRS CF chapter 2.4). There is a general presumption in the accounting statutes that fair value can be measured for an asset purchased from an outside party. The exception to this is for unquoted equity instruments and derivatives that are linked to and must be settled by delivery of such unquoted equity instrument where (1) the variability in the range of reasonable fair value estimates is significant for that instrument; and (2) the probabilities of the various estimates within the range cannot be reasonably assessed. For such situations, the financial instruments are required to be measured at Cost. (FRS 139.46)

In presenting the Playtech M&A Call Option under Fair Value for 12/31/22, Playtech provides a wide range of variability in cash flows, discount rates, growth rates, industry and market conditions. By using this presentation, Playtech inherently asserts sufficient knowledge over these variables to accurately provide the fair value of this option. I determined that this is NOT appropriate. - Should the Playtech M&A Call be valued at €524.0 million at 12/31/22?

As previously noted, I believe the Playtech M&A Call Option should be valued at its €16.8 million cost due to the fact it does not meet the IFRS requirements to a valued a fair value. However, in the event that it is determined sufficient certainty exists with respect to the valuation assumptions, I believe Playtech’s €524 million valuation substantially overstates the value of the Playtech M&A Call Option derivative financial instrument.

I performed an analysis of publicly traded companies within Caliplay and the contemplated SPAC’s industries that revealed market values have declined by 42% from December 31, 2021 to December 31, 2022. Further, smaller companies that are comparable to the proposed venture or SPAC have experienced market values declined of 54% over this same period.

1 Comment

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.